tax attorney vs cpa salary

Choosing a Tax Professional. I suppose the benefit of being a CPA and not attorney is that you graduate sooner and dont spend all that money on tuition.

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

866 303-9595 or 845.

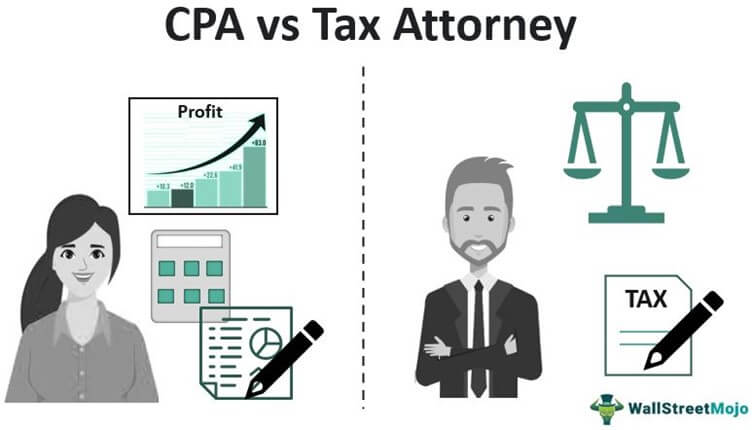

. However if youre considering the CPA vs. The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument. Lawyers who remain in the field of tax law can expect a steady increase in their annual earnings as their career progresses.

Hire a tax attorney if youre one of the unlucky 25 getting audited this year or if youre dealing with any other tax controversies. CPA Firms Become Savvier About Raising Billing Rates. Law Offices of Robert S.

Wilkinson Partners has published the 2017 instalment of our annual publication Global 100 a review of the 100 most significant tax partner moves around the globe. For tax concerns there are three kinds of people you can choose from- Enrolled Agents CPAs and Tax Attorneys. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US.

The CPA and CFP certifications are both common for financial advisors. If you find yourself in trouble with the IRS for any reason it is always best to hire a qualified attorney who specializes in tax cases as opposed to a certified public accountant CPA or any other tax professional There are several reasons for this including. As a general rule tax lawyers engage accountants CPA or EA for preparation of tax returns for their clients.

Survey Finds Tax Prep Fees Average 229. Although there is a difference between a tax attorney and a CPA members of both professions work on a variety of tax-related issues and their. As a client either certification should give you the confidence that your advisor has put in the work to master the craft.

Starting salaries tend to be somewhere between 55000 and 83000. Several factors may impact earning potential including a candidates work experience degree location and certification. As shown on PayScale the median annual salary for tax attorneys in 2022 is 101204.

My wife worked for KPMG straight out of college and had her CPA license. Tax Attorney Vs. Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often confusing universe of taxes.

Tax lawyers hourly rates are too high to justify that. It involves fewer questions and less of a time commitment. While tax preparers are still trained in financial tasks.

A tax attorney who plans during college can easily become a CPA as well. Choose a tax lawyer when receiving notices of debt. According to PayScale a tax attorneys salary starts around 80000 per year.

Accounting and the law are both fields in which professionals can work either at a firm of fellow professionals serving. And the starting biglaw salary just went up to 190k in the last year. The big 4 churn through new people you have to stay a while to make larger amounts.

Tax return preparation is a time consuming process - especially when tax situation is complex and may require multiple drafts to achieve the optimal result. Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. The average salary for a Tax Attorney is 100143.

Here are seven options you have to pay the IRS when you owe taxes from an attorney and CPA who concentrates in tax planning and estate planning. This was right before the recession but she was only getting like 55year plus a signing bonus. The average Tax Attorney II salary in the United States is 143489 as of April 26 2022 but the range typically falls between 114297 and 155202.

The Wall Street Journal. Paying close attention to detail is essential in this field because it involves complicated legal and statistical matters. Just to piggyback the starting salary for tax lawyers in a specialty practice at the Big 4 MA international is 120k in a major city like NYC or LA and 140k-150k in the National office.

The average salary of a tax attorney is 120910 per year according to the BLS. You can become a good tax attorney by improving your ability to analyze situations and think critically and creatively. The different types of tax professionals.

Reading comprehension and problem-solving ability are important skills for tax. Big Laws 1000-Plus an Hour Club. Ago CPA - US.

In this article will be talking about the differences of these three and who is the best person to hire based on your situation. Tax preparers still have to take an exam but its significantly less strenuous than the CPA test. I would hope so.

Of the UK partner moves we. CFP question you will probably lean toward a CPA if you are looking specifically for tax help. Tax Accountant or Tax Lawyer.

Salaries in the law field range from 58220 to 208000. Conversely if a dual-licensed Attorney-CPA decides to continue an accounting career he has a distinct advantage over most CPAs due to his familiarity with the. Tax preparers can learn their trade on the job whereas accountants and CPAs must obtain their Bachelors degree in Accounting.

7031 Koll Center Pkwy Pleasanton CA 94566. EA vs CPA vs Tax Attorney.

Average Accountant Salary How Much Do Accountants Make Accounting Salary Http Gazettereview Com 201 Accounting Companies In Dubai Accounting And Finance

Insurance For Your Accounting Business 520 917 5295 Accounting Career Online Training Courses Business Insurance

Schedule An Appointment With Thecpataxproblemsolver Today Using His Online Booking System Choose Your Date And Time Click In 2020 Irs Taxes Tax Prep Filing Taxes

Tax Attorney Vs Cpa What S The Difference

The Difference Between A Cpa And A Tax Lawyer In California

It Forum Design Forums Design Show And Tell Design

The Difference Between A Tax Cpa And Ea All Your Questions Answered Basics Beyond

Cpa Vs Tax Attorney What S The Difference

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

How Are The Bar Exam And Cpa Exam Different Compare And Find Out Which Is Right For You Cpaexam Cpa Bar Barexam Cpa Exam Studying Cpa Exam Bar Exam

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Non Cpa Salary Key Differences Comparisons

What Can You Do With An Accounting Degree Accounting Degree Accounting Jobs Accounting

Senior Tax Manager Job Description Example Job Description And Resume Examples Income Tax Return Indirect Tax Income Tax

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Payroll Tax Definition Payroll Taxes Payroll Tax Attorney

3 Best Software That Accountants Use For Accounting Services Sip Accountants Company Financials Accounting Accounting Services